What You Need To Know Ahead of Akamai Technologies' Earnings Release

/Akamai%20Technologies%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $10.8 billion, Akamai Technologies, Inc. (AKAM) is a global leader in content delivery networks and cloud infrastructure services, providing solutions that enhance the speed, security, and scalability of web applications. Based in Cambridge, Massachusetts, it offers a wide range of services, including security, performance optimization, and media delivery to businesses worldwide.

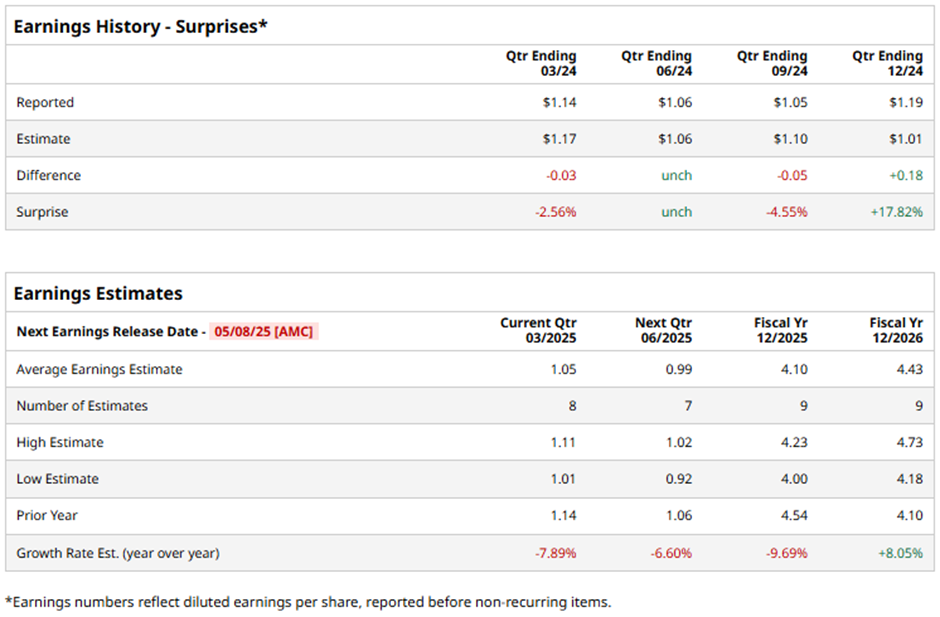

AKAM is slated to announce its fiscal Q1 2025 earnings results after the market closes on Thursday, May 8. Ahead of this event, analysts expect the company to report a profit of $1.05 per share, a 7.9% drop from $1.14 per share in the year-ago quarter. It has exceeded or met Wall Street's earnings expectations in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the cloud services provider to report EPS of $4.10, marking a decrease of 9.7% from $4.54 in fiscal 2024. However, EPS is anticipated to grow 8.1% year-over-year to $4.43 in fiscal 2026.

Shares of Akamai Technologies have declined 21.6% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 9.4% rise and the Technology Select Sector SPDR Fund's (XLK) 4.2% gain over the same period.

Despite reporting stronger-than-expected Q4 2024 adjusted EPS of $1.66 and revenue of $1.02 billion on Feb. 20, Akamai’s shares tumbled 21.7% the following day. The company's Q1 EPS guidance of $1.54 to $1.59 and its expected revenue range of $1 billion to $1.02 billion both fell short of the analysts' expectations. For fiscal year 2025, Akamai projected EPS to be between $6 and $6.40 and revenue to be between $4 billion and $4.20 billion, lower than Wall Street's expectations.

Furthermore, Akamai indicated that political headwinds faced by one of its largest customers could negatively impact its top line by 1% to 2% over the next few years.

Analysts' consensus view on Akamai Technologies stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 20 analysts covering the stock, nine recommend a "Strong Buy," one "Moderate Buy," nine "Holds," and one "Strong Sell." As of writing, AKAM is trading below the average analyst price target of $102.37.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.